GLOBAL MARKETS STEADY AS CENTRAL BANK SIGNALS COOL RATE PATH INTO 2026

Policy guidance shapes investor mood

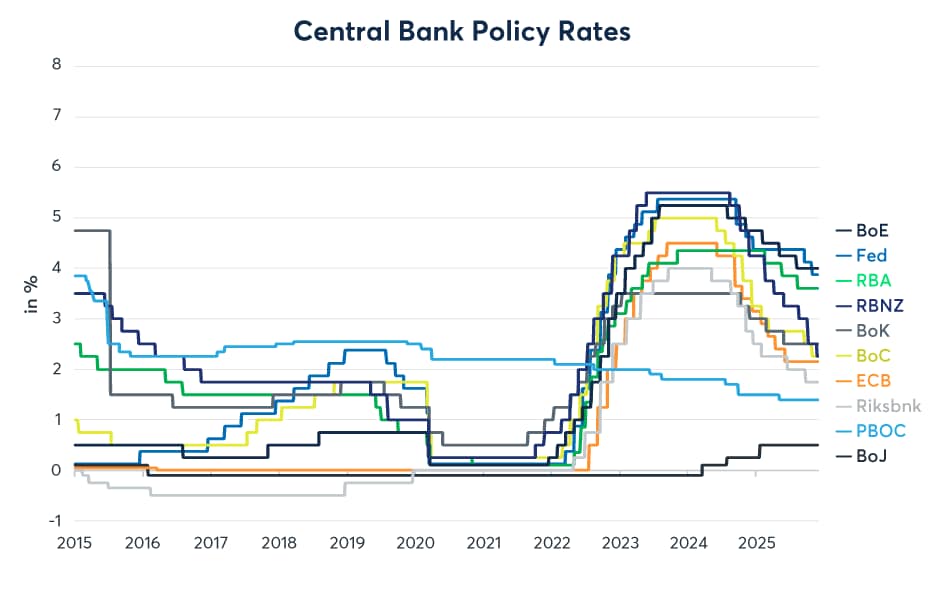

Global financial markets moved cautiously on Tuesday as investors parsed fresh signals from major central banks pointing to a slower pace of interest-rate cuts in 2026, even as inflation continues to ease across advanced economies. Equity benchmarks in Europe and Asia ended mixed, while U.S. futures hovered near flat levels ahead of key data releases. Bond yields edged higher, reflecting expectations that policy rates will stay restrictive longer than previously hoped.

Currency markets were similarly restrained. The dollar firmed modestly against a basket of peers as traders reassessed the timing of the Federal Reserve’s next move. Emerging market currencies showed limited volatility, helped by stable commodity prices and a lull in geopolitical shocks. Analysts said positioning remains light, with many investors preferring to wait for clearer guidance before making large allocations.

Policy risks remain in focus

Central bank officials from the United States and Europe stressed that recent disinflation does not guarantee a smooth path back to target levels. Several policymakers warned against premature easing, citing sticky services inflation and resilient labor markets. That tone tempered optimism built earlier this month when headline inflation readings surprised on the downside.

Market participants are now recalibrating expectations for 2026 growth. Economists say tighter financial conditions could weigh on investment, but household spending has so far held up better than feared. For portfolio managers, the challenge is balancing defensive positions with selective risk-taking in sectors linked to productivity and energy transition.