AWS unveils new Nova AI models and a bid for customer control

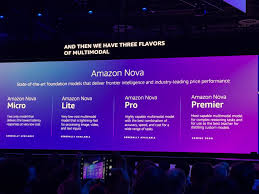

Four new models and a “frontier” service

Amazon Web Services has expanded its Nova family of artificial intelligence models with four new releases aimed at enterprises that want more tailored AI tools. The lineup now includes frontier-scale systems designed for complex reasoning and multimodal tasks, alongside smaller, more efficient versions that can run at lower cost. AWS is pitching the new models as a way for customers to build chatbots, document-processing tools and creative applications without having to assemble their own training pipelines from scratch.

Alongside the models, the company introduced a service that lets businesses create customised versions of Nova using their own data while keeping sensitive information locked down. The promise is that customers can tune behaviour, domain knowledge and style without handing over proprietary datasets for broad reuse. AWS executives are emphasising that firms will be able to choose where their models run, from fully managed cloud options to environments with stricter regulatory controls. That flexibility is meant to reassure industries such as finance, healthcare and government, where data governance rules are tight.

The new Nova releases arrive at a crowded moment in the AI race. Rivals Microsoft and Google have been pushing their own large models and copilots deep into productivity suites, developer tools and consumer apps. AWS, which long dominated cloud infrastructure, has been viewed as moving more cautiously in generative AI, relying heavily on partners as well as its own technologies. With this announcement, the company is trying to show that it can offer both high-end capabilities and a broad menu of model sizes under one umbrella.

Pricing and performance details will matter as customers decide whether to shift workloads. Many firms already juggling multiple AI vendors are wary of new forms of lock-in, especially if moving applications between providers remains technically complex. AWS is arguing that its focus on choice—between first-party Nova models, open-source options and third-party systems—gives developers a safer long-term bet. Analysts note, however, that true interoperability will still depend on standards that go beyond one company’s ecosystem.

Data security and responsible use are central to the sales pitch. AWS is highlighting guardrails for filtering harmful content, tools for monitoring model behaviour and dashboards that track how often outputs are rejected or corrected. The company says it wants to make it easier for corporate compliance teams to document how AI tools are used, which regulations apply and what internal controls exist. That approach reflects growing pressure from regulators and boards, who are demanding more transparency before allowing AI to touch core business processes.

For many customers, the appeal of Nova will be measured less in benchmarks and more in how quickly it can be integrated into existing workflows. Enterprises are looking for ways to automate repetitive tasks, summarise sprawling datasets and assist front-line staff without losing human oversight. If the new service genuinely lets them dial in customised behaviour while keeping data siloed, it could make AWS a more comfortable choice for risk-averse organisations.

At the same time, there is a broader question about AI spending. After a surge of pilots and experiments, some companies are pulling back, asking which projects are actually delivering value. AWS is effectively betting that a mix of powerful general models, tightly controlled fine-tuning and flexible deployment options will keep AI budgets flowing toward its platform. The coming quarters will reveal whether this strategy can convert interest into durable, large-scale contracts.