TRUMP AIMS TO SUPERCHARGE U.S. LNG EXPORTS—CAN PRICES STAY LOW?

Policy push vs. market math

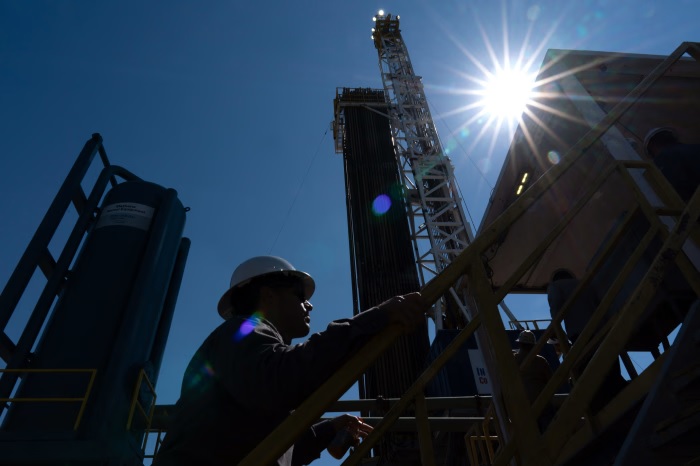

The White House is pressing for more U.S. liquefied natural gas (LNG) exports to bring down domestic energy prices and project strength abroad. On October 14, reporting highlighted the paradox: more exports can support producers and allies but also tighten local supply, especially during winter peaks. Developers are racing to complete Gulf Coast terminals just as Europe and parts of Asia line up long-term contracts. At the same time, a softening global economy and volatile freight have whipsawed spot prices this year. Traders said policy signaling matters, but infrastructure lead times and shipping constraints will determine what hits the market—and when.

The road ahead

Analysts see three swing factors. First, U.S. production growth: associated gas from oil drilling could keep supplies ample, but capital discipline has limited wild surges. Second, permitting: court fights and federal reviews can delay pipelines and terminals, capping near-term exports. Third, global demand: if Asian heat waves or cold snaps return, spot prices could spike and draw cargoes away from Europe. Consumer bills in the U.S. depend on storage levels heading into winter; utilities are hedging more to smooth shocks. Longer term, the export buildout raises climate questions—methane leakage and lifecycle emissions will face tighter scrutiny. The balancing act for policymakers is to expand capacity without stoking domestic price spikes.