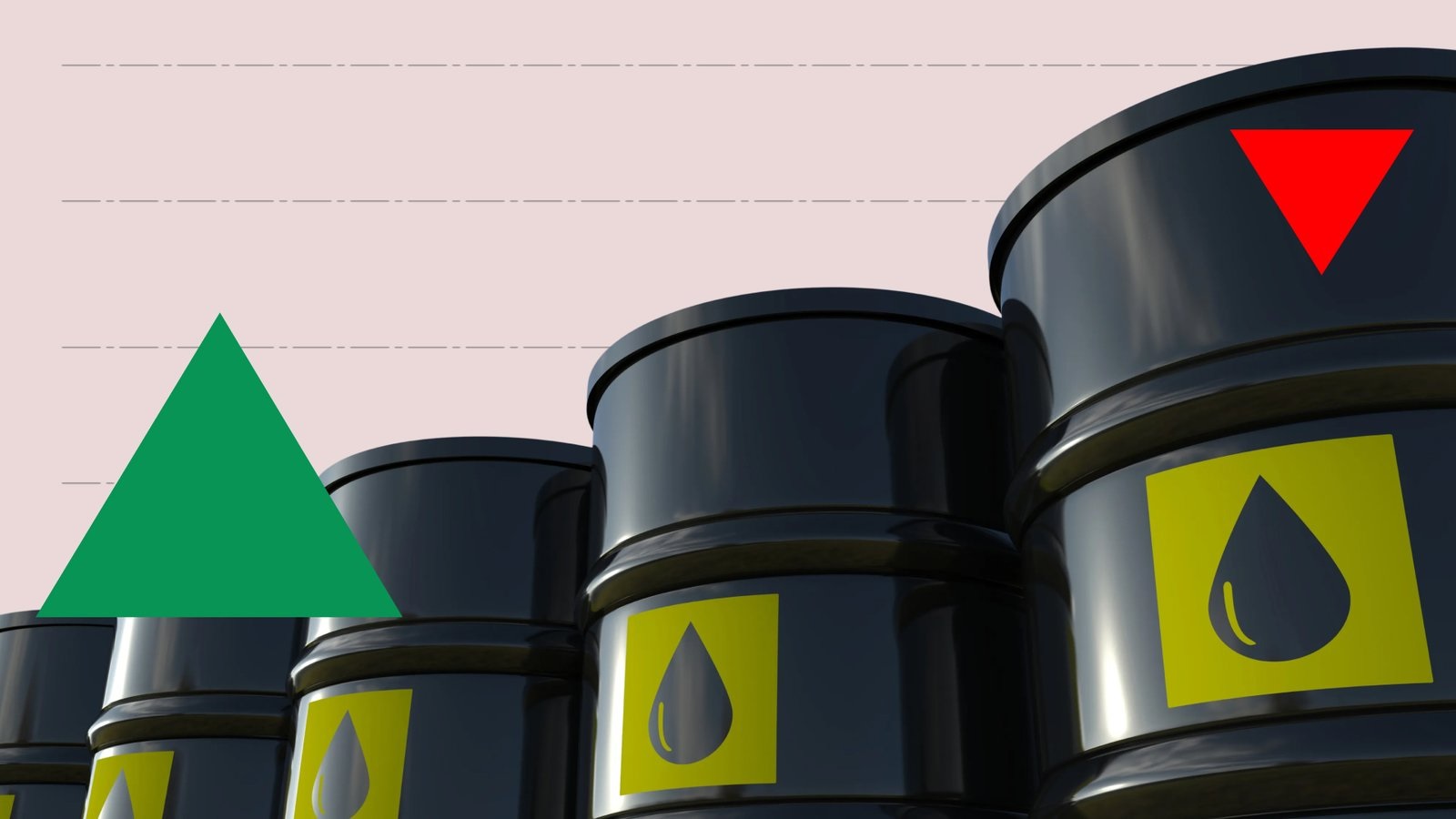

EUROPEAN GAS PRICES DRIFT LOWER BUT STAY IN NARROW RANGE

Mild weather and full storage cap volatility

European natural gas prices edged lower Friday but stayed within a narrow band, reflecting balanced fundamentals heading into late autumn. Ample storage after months of strong imports has cushioned the market against sudden spikes, while a softer economic outlook has trimmed industrial demand. Utilities are taking advantage of the calmer environment to lock in winter hedges, aiming to avoid the price shocks seen during the 2022 crisis.

Weather forecasts remain the market’s main swing factor. Current models point to slightly warmer temperatures across northern Europe over the next two weeks. A sudden cold snap, however, could sharply increase heating demand and put upward pressure on contracts. Logistic issues—including scheduled maintenance at key LNG terminals—remain potential flashpoints, though none are viewed as immediate threats.

Policy risks and household budgets

European governments still treat gas prices as a core inflation driver. Economists say today’s relatively stable curve gives policymakers a bit more breathing room as they consider rate adjustments and targeted support for vulnerable households. Some countries are also using the calmer period to accelerate insulation upgrades, grid investments and heat-pump subsidies to permanently reduce dependence on imported gas.

Consumers may not feel the effects immediately. National tariff systems and fixed-rate contracts mean bill reductions appear slowly and unevenly. Analysts recommend using the current lull to invest in efficiency upgrades that can mitigate future volatility. Overall, the message from traders is one of cautious calm: Europe is better prepared than in recent winters but remains exposed to weather and geopolitical surprises.