China’s $1 Trillion Trade Surplus Puts Global Partners on Edge

Drivers behind the record surplus

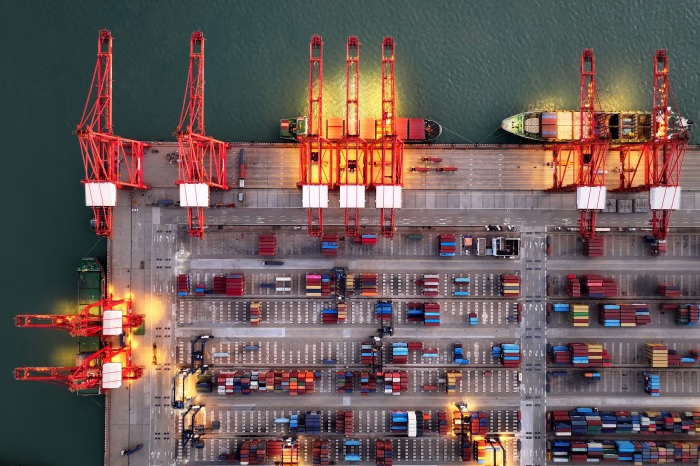

China has crossed a symbolic economic threshold, with its annual trade surplus topping $1 trillion for the first time, according to new customs and government data. The milestone reflects a potent mix of resilient exports in autos, machinery and electronics, and cooling domestic demand that has kept imports comparatively weak. For Beijing, the surplus offers hard currency buffers and leverage in a slowing global economy, but it also sharpens longstanding accusations that China relies too heavily on export-led growth. Policymakers in Washington and Brussels are scrutinising whether industrial subsidies and state-directed credit are allowing Chinese firms to undercut rivals abroad, especially in electric vehicles and green technologies. That debate is already feeding into calls for fresh tariffs, anti-dumping investigations, and tighter investment screening rules.

Trade tensions spill into policy and politics

Major trading partners now face a tricky balancing act: they depend on Chinese supply chains and cheap consumer goods, yet struggle with domestic pressures to “re-shore” manufacturing and protect local jobs. In the U.S., the data strengthen arguments for maintaining or even expanding Trump-era tariffs, while in Europe officials are weighing more targeted measures aimed at sectors like batteries, solar panels and EVs. China, for its part, insists its export gains reflect efficiency and innovation rather than unfair practices, and warns that escalating trade barriers could disrupt global supply chains just as growth shows tentative signs of stabilising. Economists say the surplus also underlines persistent weakness in Chinese household consumption, raising questions over the durability of its recovery. For countries such as Germany, South Korea and emerging Asian exporters tied into China’s production networks, any policy swing—whether toward tariffs or subsidies—will reverberate through factories, ports and currency markets in the months ahead.